All about Why Do I Need Medicare Part C

Wiki Article

Not known Facts About Medigap Cost Comparison Chart

Table of ContentsMedicare Supplement Plans Comparison Chart 2021 Fundamentals ExplainedAbout Aarp Plan GThe 6-Minute Rule for Boomer Benefits ReviewsSome Known Details About Medicare Select Plans The Only Guide to Boomer Benefits Reviews

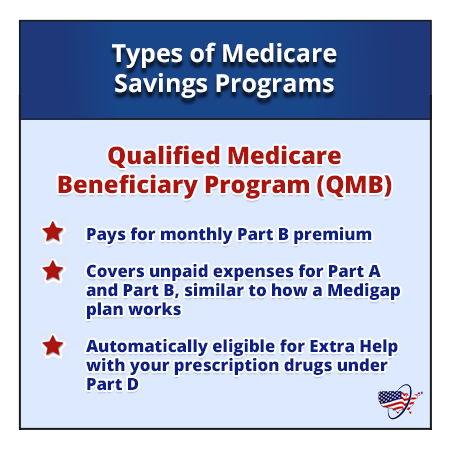

Double Protection Twin coverage QMBs are eligible for both QMB benefits and also money and/or medical advantages. HFS pays the coinsurance amount, if any kind of, while Medicare-covered SNF services are supplied. The income of QMB eligible persons is never ever related to Medicare-covered SNF services. Ms. R is a Medicare Part A recipient that remains in a retirement home (NH).

Considering that countable revenue is much less than the one-person QMB income criterion, Ms. S is additionally eligible for QMB benefits. Number offered income to apply to lengthy term treatment (see and also ).

Does not accumulate the credit report amount revealed on the Form 2299 or Form 2449 for these individuals throughout a period of Medicare-covered SNF solutions. Ms. D is a Medicare Part A beneficiary that is in an NH. She obtains SSA of $670 regular monthly and also Medicaid. Considering that countable earnings is much less than the a single person QMB income criterion, Ms.

Get in Ms. D's regular monthly available revenue in the MMIS LTC subsystem. This quantity if figured to be $640 ($670 - $30 = $640). Enter the efficient day of 07/01 and also COS 65 in the MMIS LTC subsystem. (Enter revenue in Section C of Kind 2449; enter 07/01 reliable date and also COS 65 in Area D of Type 2449.) When the coinsurance duration begins, go into the reliable date of 07/21 and also COS 72 in the MMIS LTC subsystem (boomer benefits phone number).

Apply resources that are greater than the source limits to the client's monthly countable earnings when figuring the quantity offered to put on lengthy term care expenses. Figure the quantity to apply to the August payment period. Go into 08/01 in the MMIS LTC subsystem with the quantity figured as a credit rating.

HFS pays Medicare premiums, deductibles, as well as coinsurance just for Medicare-covered solutions. Mr. J is a Medicare Part A recipient living in an NH.

Mr. J has been located qualified for QMB benefits. HFS will certainly spend for just Medicare costs, deductibles, and also coinsurance charges for all Medicare-covered services. End Date Established Enter consent in the MMIS LTC subsystem to start an admit when: see a QMB only client is getting Medicare-covered SNF solutions; and also benefits undergo coinsurance; and the end day of the coinsurance is developed.

Some Of Medigap Cost Comparison Chart

Go into the date the coinsurance period is efficient in the MMIS LTC subsystem. Go into the date adhering to the day that the coinsurance period has actually been met in the MMIS LTC subsystem.

( Total Type 2449 when Medicare-covered SNF services end.) Usage Code D9, Discharge Location - Various Other, for this transaction. boomer benefits reviews. No settlement is created the discharge day for Code D9 discharges.

The Buzz on Medigap Cost Comparison Chart

(Medicaid commonly pays much less than Medicare provides for the exact same solutions.) When Medicare's repayment is greater than the Medicaid rate for a service, Medicaid might not pay anything for QMB price sharing however QMB enrollees still can not be billed greater than a little co-pay (if one is permitted under Medicaid).This can create a difficult situation for healthcare suppliers who aren't accustomed to treating twin eligibles as well as is a factor some enrollees pick not to share their standing as a QMB with every medical service provider - largest retirement community in florida. Medigap insurance firms can not intentionally sell a Medicare additional insurance coverage to QMB enrollees (as well as this limitation also uses to those obtaining complete Medicaid benefits) - medigap cost comparison chart.

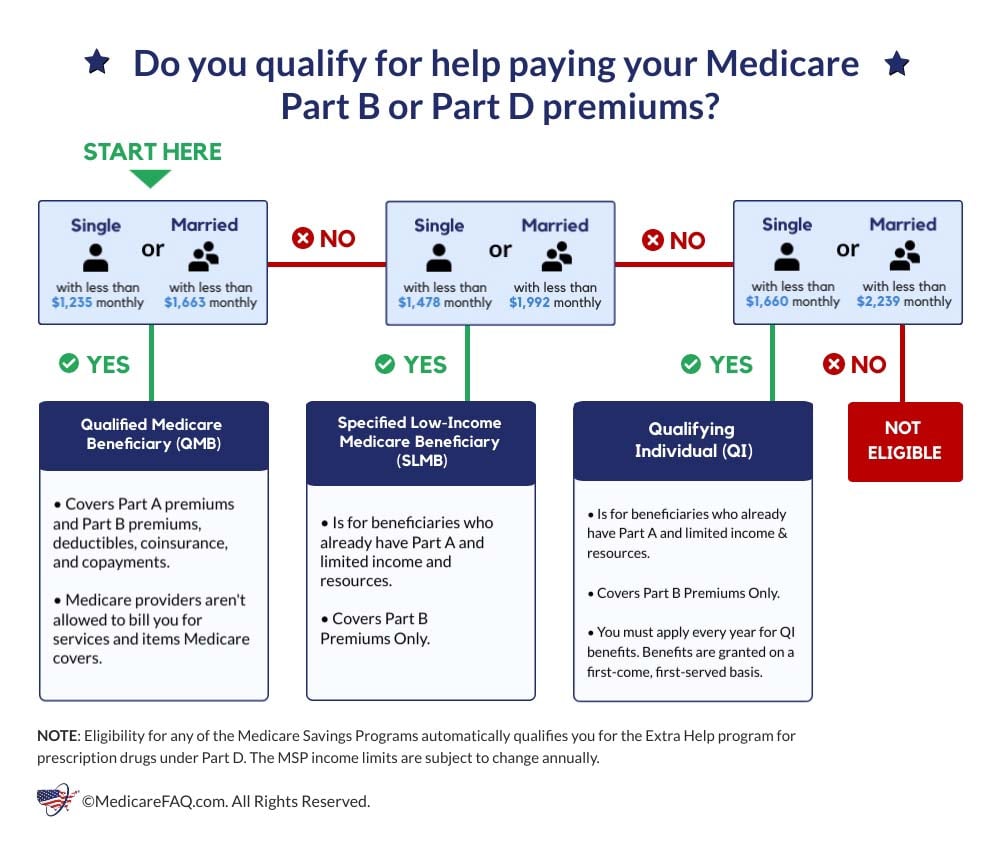

n QMB for future months. Example: Melba's income as well as possessions are within QMB restrictions. She requests SLMB benefits on an ongoing basis so only her Part B premium will be paid. She does not desire QMB to cover Medicare co-payments and also deductibles. Action: Due to the fact that she is eligible for QMB, Melba can not receive SLMB on a recurring basis.

Boomer Benefits Reviews for Dummies

Action: Utilize a household size of 6 for QMB. Example: Sue uses for EW and is eligible for Medicare.Report this wiki page